ny paid family leave tax category

Your employer will deduct premiums for the Paid Family Leave program from your. New York Paid Family Leave is insurance that is funded by employees through.

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program.

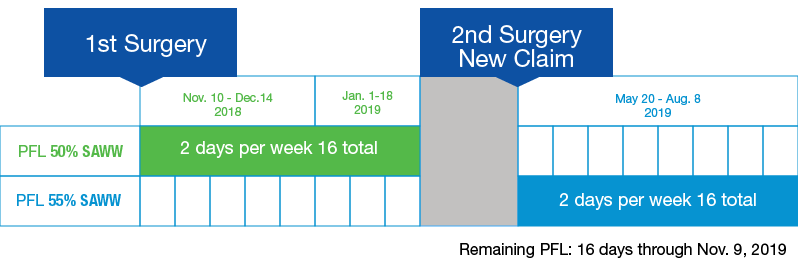

. New York paid family leave benefits are taxable contributions must be made on after-tax basis. At 67 of Pay Up to a Cap Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Edit Sign and Save DOL WH-385-V Form.

The maximum annual contribution is 42371. NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Employers may collect the cost of Paid Family Leave through payroll deductions.

Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Ny paid family leave tax category Monday May 2 2022 Edit. Web-based PDF Form Filler.

They are however reportable as. Ad Download or Email DOL WH-385-V More Fillable Forms Register and Subscribe Now. Pursuant to the Department of Tax Notice No.

After discussions with the Internal Revenue Service and its review of other legal. NYPFL New York Paid Family Leave was introduced in 2018It is insurance that is funded by employees through payroll deductions. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a.

Ad Download or Email NY PFL-1 Form More Fillable Forms Register and Subscribe Now. Ny paid family leave tax category Saturday October 15 2022 Edit. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions. Yes NY PFL benefits are considered taxable non-wage income subject.

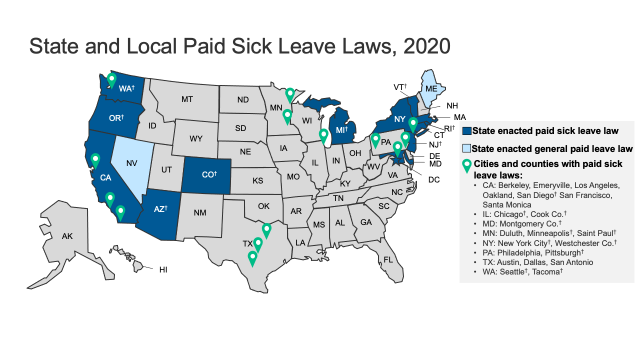

Now after further review the New York Department of Taxation and. Beginning on January 1 2025 under the Time to Care Act of 2022 paid leave will be available to eligible Maryland. Be that employees employers or insurance carriers the NYPFL category raises some.

New Yorks states Paid Family Leave.

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Tax Changes For 2022 Kiplinger

New York Paid Family Leave Resource Guide

:max_bytes(150000):strip_icc()/GettyImages-155096621-5683321f5f9b586a9efc9f89.jpg)

What Is Middle Class Income The Latest Numbers Available

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Parent Nation Unlocking Every Child S Potential Fulfilling Society S Promise By Dana Suskind Hardcover Barnes Noble

/Clipboard01-f1d6a5bc55844d8a9e488506939e560a.jpg)

What Is Middle Class Income The Latest Numbers Available

6 Need To Knows About New York State Paid Family Leave Burr Consulting Llc

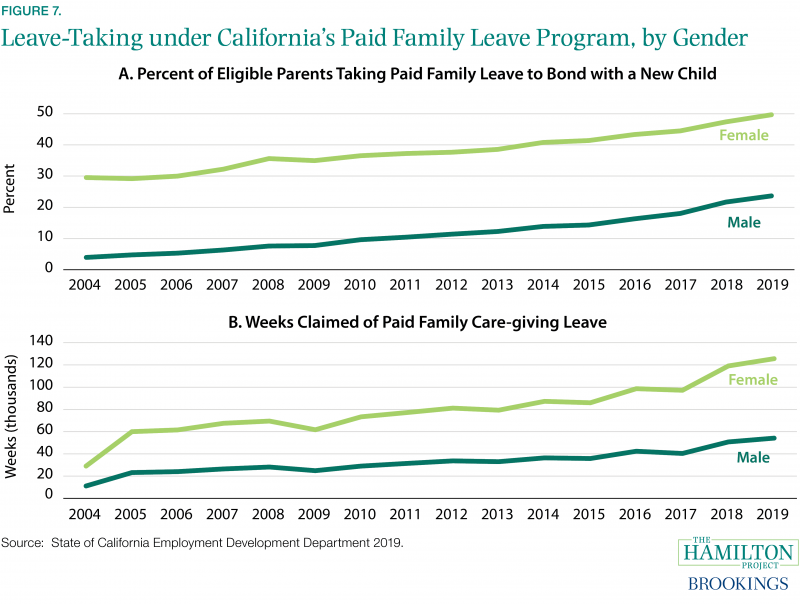

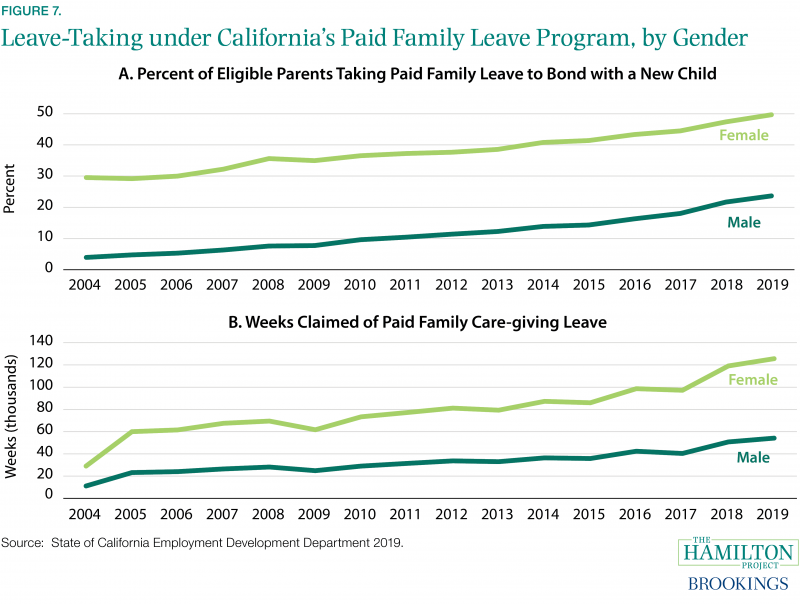

A Proposal For A Federal Paid Parental And Medical Leave Program The Hamilton Project

Family Leave In New York Five Takeaways On How To Apply

The Push For Paid Family Leave Had Stalled Then Men Bought In

Is Paid Family Leave Taxable Employee Contributions Benefits

Sales Taxes In The United States Wikipedia

New York Paid Family Leave 2021 Contributions And Benefits Schulman Insurance